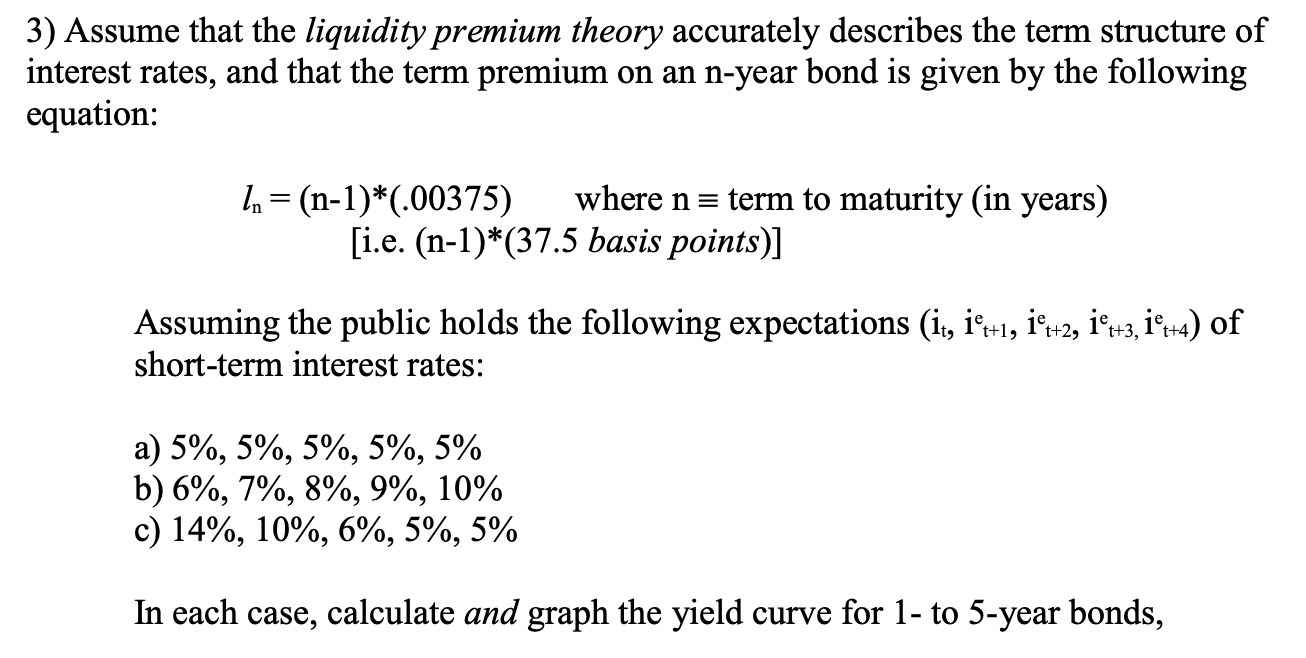

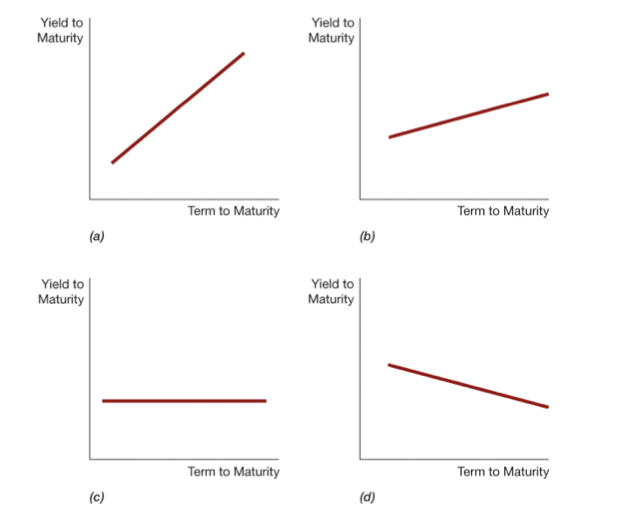

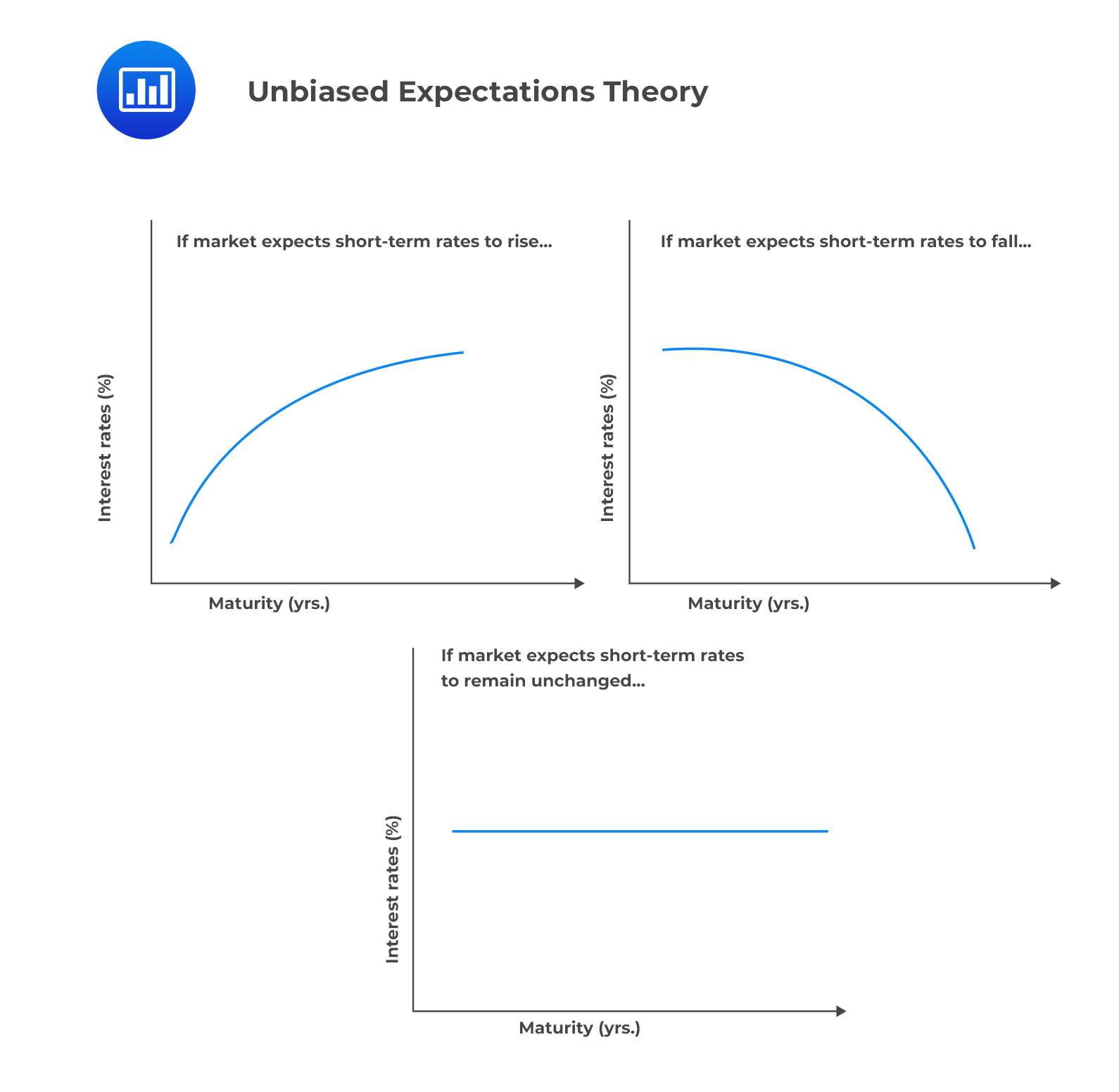

Can someone help me understand the figures under the expectations theory and liquidity premium theory of term structures in the book Financial institutions and Markets by Jeff Madura (2008)? I'll leave the

EC247 FINANCIAL INSTRUMENTS AND CAPITAL MARKETS TERM PAPER NAME: IOANNA KOULLOUROU REG. NUMBER: 1004216

Traditional Theories of the Term Structure of Interest Rates - CFA, FRM, and Actuarial Exams Study Notes

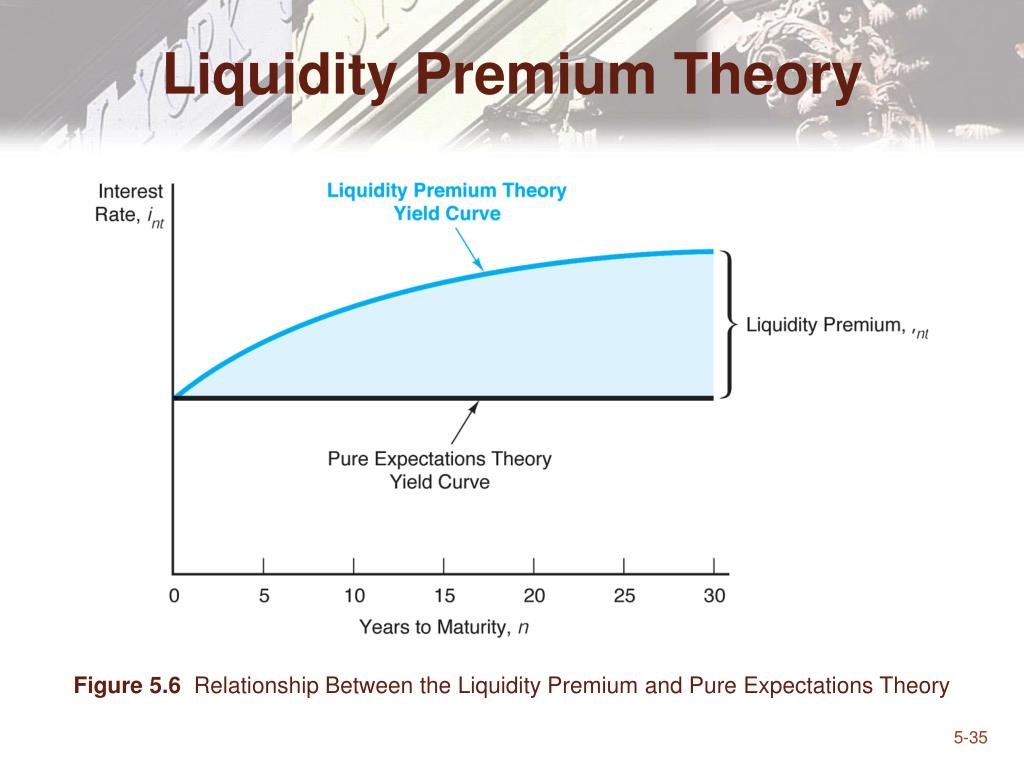

FNCE 4070 Financial Markets and Institutions Lecture 5: Part 2 Forecasting With the Term Structure of Interest Rates (1) Forecasting Business Cycle Turning. - ppt download

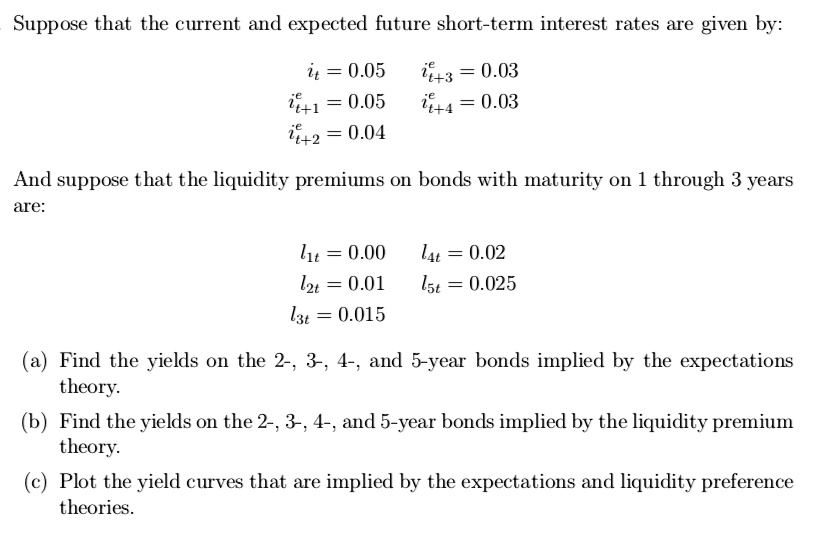

SOLVED: Suppose that the current and expected future short-term interest rates are given by: it = 0.05, ie+1 = 0.05, ie+2 = 0.04, ie+3 = 0.03, ie+4 = 0.03. And suppose that

FNCE 4070: FINANCIAL MARKETS AND INSTITUTIONS Lecture 5: The Term Structure of Interest Rates Yield Curves: How do we Construct a Yield Curve and What. - ppt video online download

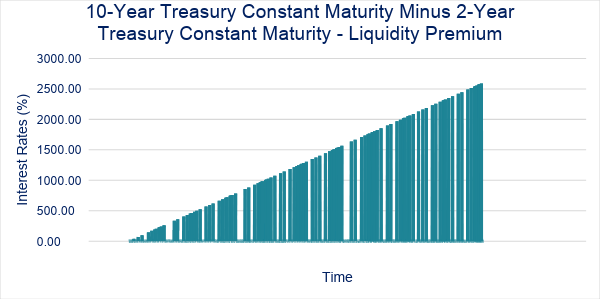

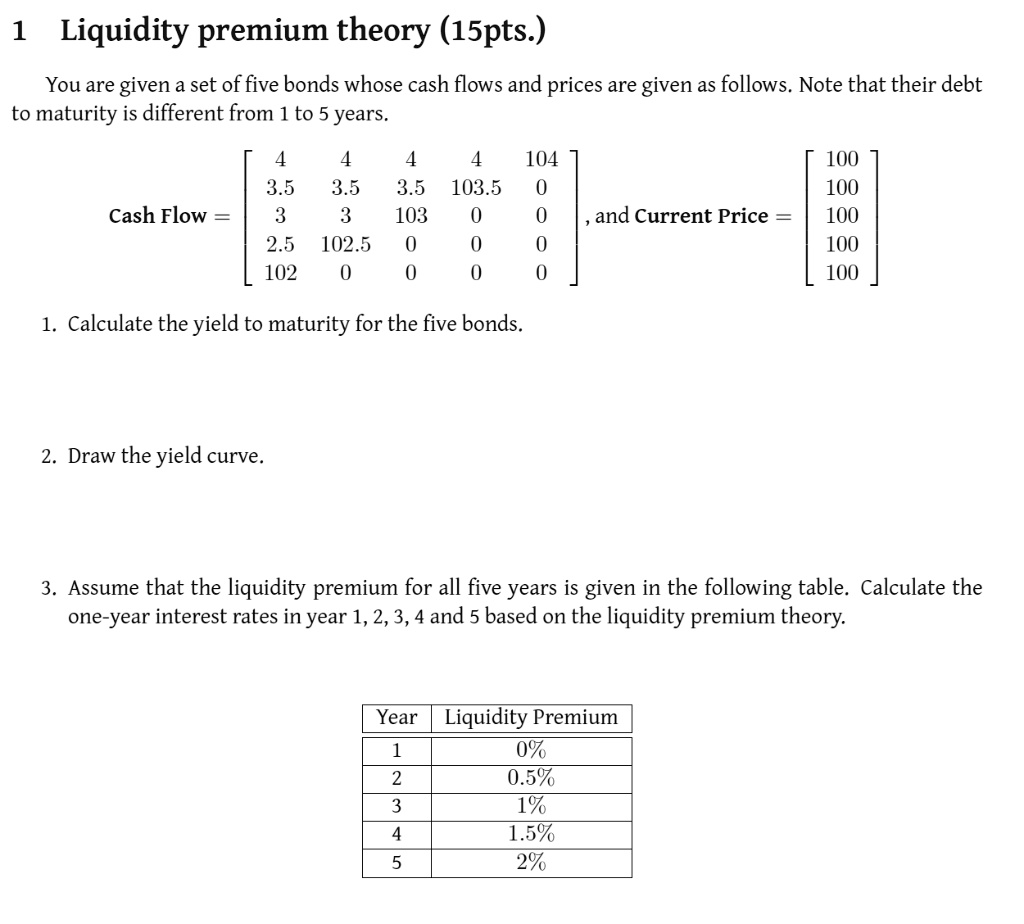

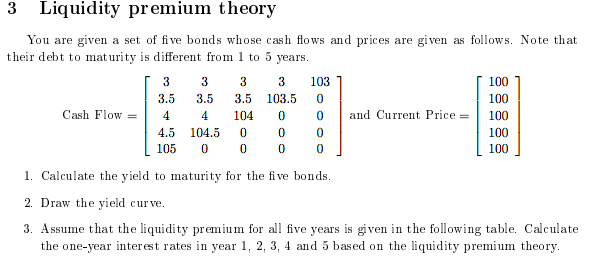

One-year interest rate over the next five years are 4%, 4.5%, 6%, 8%, and 9% respectively. Liquidity premiums for one- to five-year bonds are estimated to be 0%, 0.5%, 1.5%, 2.5%, and

:max_bytes(150000):strip_icc()/liquiditypreference.asp-final-61b55e392c86409fb0b4cf0e2315bd40.jpg)